How I Made Over $1000 in the Stock Market Last Week

Even Though This is a True Story.,.

I want to be clear I am not making $1000 every week. This was just a really good week for me, the kind I want to have more of.

I trade stocks. I am something between a day trader and a swing trader.

The definition of a day trader is someone who buys and sells stocks in the same company in the same day. There is also a definition of what they call a "pattern day trader" who does this 4 or more times a week. They (the FED) require you to have $25,000 in your trading account before they will let you do this. One of the reasons for my in-between status is that I don't have that much money to work with.

So, I am limited to 3 "round-trip" trades a week. Leaving me with an incentive to leave my money in overnight on some or all of my trades. None of my trades this week lasted more than 24 hours though, so I think of myself as a day trader whether I fit the technical definition or not.

I Break a Lot of Rules

Like that rule about putting all your eggs in one basket? That's fine for the person who has two baskets and a lot of eggs.

I don't have a lot of cash. I started my journey into investing with $1000 from my tax return. (2002) Back then I was more interested in the rules and in doing everything "right". So I did a lot of research, followed expert recommendations, and diversified my portfolio. I intended to "buy and hold" and probably buy more with the next year's tax return.

What I really did was buy and forget.

About 3 years later I hacked into my trading account... (one does tend to forget their password over time.) I discovered that I now owned 8 stocks. Two had gone out of business. One had tripled in value, and the others were doing about the same as when I bought them.

Wow.

That's not how it was supposed to work. What about all that "magic of compound interest" and the market average going up 10-12% every year? I'm pretty sure my $1000 should have turned into $1500, not $800.

I sold everything. (I was going through bankruptcy at the time and that's what the court told me to do.) But I kept the account open and decided to add to it. I realized I'd made a couple mistakes. One was not paying attention to what was going on.

The other was "diversifying" when I only had $1000 to begin with! That's $200 in trading fees. What if I had only bought that one stock? (...the one that tripled in value?)

From then on, I've bet the farm on every trade I've made. There will come a time when I diversify... but not until I have enough money to make the trading fees less significant.

(Like I tried to tell you earlier, this is my experience, not solid advice for anyone to follow.)

I Have to Learn Most Things the Hard Way

I started driving a truck shortly after my bankruptcy. I try to live frugally, even on the road. All the money I saved went right into my trading account.

I got a satellite radio with a stock ticker application and watched stock prices all day while I drove. (Not constantly, just glancing from time to time, when the traffic was light.) I may have to learn things the hard way, but I do learn. I got to know some of the companies I was watching pretty well... nothing special, Microsoft, Netfilx, big names companies that had products I understood.

I learned the ranges that these stocks traded in. When the price was down on one, I'd buy some. I'd hold it until the price when up to the top of the range and then get out, (This is trading, not investing, but I didn't even know that at the time...)

I began to research daily ranges, highs and lows, and keep spreadsheets and graphs. If a stock I was watching didn't have enough "wiggle room" to make an easy profit in a week's time or less, I'd dump it and pick another one.

Discovering Penny Stocks

I never would have thought I'd play around in the stock market, let alone play around with penny stocks. But one day I had a little extra cash...

I bought some shares of Netflix and had about $200 left over. I was feeling good about Netflix and thought I'd make more than $200 on it so I could blow the extra cash if I wanted to. No harm done.

I found a stock that was trading at about $.20 and bought 1000 shares. There was just something about the chart that looked to me like it was going to take off soon. I didn't know squat about technical analysis back then, but I had a feeling. I sold the shares a week later at about $200. Meanwhile, I made my original $200 back from Netflix too.

Looking at those two trades side by side like that really opened my eyes to the potential of penny stocks. Especially for someone without a lot of cash to begin with.

Important Restrictions on Day Trading

Some Good Books on Trading

If Penny Stocks Have Potential, What About Day Trading?

What about day trading penny stocks?

My truck broke down and my company put me up in a hotel while it was being fixed. They had Internet access and I decided to try my hand at day trading. I'd seen what penny stocks were capable of. I understood how I could make money from the daily ups and downs. I was even pretty decent at reading charts and picking entry and exit points. So what the heck?

What I didn't know was the first thing about day trading. I probably still had less than $5000 to work with. I didn't know there were any regulations limiting day trading accounts. I did have a margin account, although I had never used the "margin" part of it, and probably would not have cared about losing my margin even if I'd known that could happen.

I made several trades. Most of them worked out. One didn't in a big way and I lost at least as much as I made on the others.

The big shock though, was the next morning when I got up. There was a really nasty letter in my email about how I broke some federal regulation or something and so my margin had been revoked for 3 months. And it felt like when I was a little kid getting sent to bed without supper for no apparent reason.

Two things I learned... First, there are some serious regulations you need to know if you want to day trade (see the video if I haven't made them clear enough yet...)

The other thing was about limit orders vs. market orders. At the time the limit orders were a little more expensive. I did all my trading with market orders. That was what hurt me so badly with that one trade. The price was great when I got in, and great when I put the sell order in. What wasn't great was the volume. All my shares sold, but as they did the price dropped through the floor. Most of them at a loss.

Oh...

I mean there are books and things that explain all this. I could have read some of them. But at the time I was just playing around doing everything on my own. I was experimenting and learning what works and what doesn't.

They Call it Tuition

Almost every trading book I have read (yes, I read them now...) has talked about "tuition." They say that new traders always lose the first few years, even the ones that do this for investment firms after going to Harvard and other big name schools. The companies they work for call it tuition to. They are paying for training.

So I have paid some dues. In about 8 years I have only had to pay taxes on capital gains once, and that was for $500.

I've had more winners than losers, but my losers have been much bigger than the winners. Usually one big loss will wipe out all the smaller wins. If I had bothered to educate myself before I started trading I might have learned something about money management and setting a stop loss.

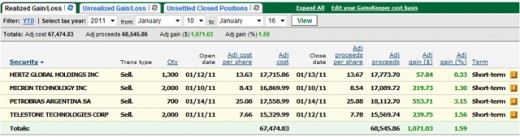

Last Week's Gain & Loss Report

And There is My Proof...

Now that you know my whole history with trading, you can see why I am so excited about how things went this week.

Oh, and if it's too blurry to read the screenshot (it shrunk a little when I uploaded it) the actual trades were:

Hertz Global Holdings, Inc

| 1/12/11

| 1/13/11

| 57.84

|

Micron Technology, Inc

| 1/10/11

| 1/10/11

| 219.73

|

Petrobras Argentina SA

| 1/14/11

| 1/14/11

| 553.71

|

Telestone Technologies Corp

| 1/11/11

| 1/12/11

| 239.75

|

1,071.03

|

Still Learning

I'm still learning. One of the lessons I've been focused on in the past couple of months is limiting my losses. I tend to hold on to a stock thinking that eventually it will go up and I'll get my price. I've lost almost $3000 on one trade because I was just too stubborn to admit I was wrong.

I'm getting better at that. The week before this my big loser was only -$440. This week my big loser was +$58.00. The problem is, if you can't admit that the stock is not performing the way you want it to, or think it should... a $58 gain can turn into a $440 loss, or even a $3000 loss pretty quickly.

I think I've been so slow to learn this lesson because I've always been pretty lucky about picking good stocks. With all the winners, I don't feel the losses so badly. Most years I come pretty close to breaking even. This year though, I am going to learn everything I can about trading in hopes that I can make a living at it... just in case my weight loss project doesn't turn out.

Another lesson I need to learn is not to jump out of a winning stock too fast. Both Micron and Telstone could have made me close to $2000 if I'd been willing to hold onto them another day. But for now I am very happy to have made money and not turned around and lost it immediately in the next trade!

Like He Says... My Answer is Almost the Same